[Bitop Review] Crypto Technical Analysis:LTC、ADA

2025年04月25日发布

LTC

LTC has been on an upward trend since June 2022, forming an ascending channel (purple parallel channel). Despite a few breakdowns, it quickly found support and recovered. By late November 2024, it formed a flag/descending channel (green parallel channel), typically a bullish signal, but broke below it by late March.

However, the price soon found support within the larger ascending channel, indicating the support remains valid. The late March breakdown appears more like a liquidity grab.

Currently, the price has risen about 28% from the channel bottom, but it remains a relatively good buying opportunity. Investors can consider buying spot at market price for mid-to-long-term holding or wait for a pullback to the green channel bottom. Partial profit-taking is recommended near the channel top, around $145–$165. Watch for breakout signals to decide whether to hold further. Set a stop-loss below $63, the low of the channel breakdown.

Summary and Key Levels:

Direction: Long

Entry: $80.5 – $83.5 (market price)

Take Profit: $145 – $165

Stop-Loss: $63 (previous low)

ADA

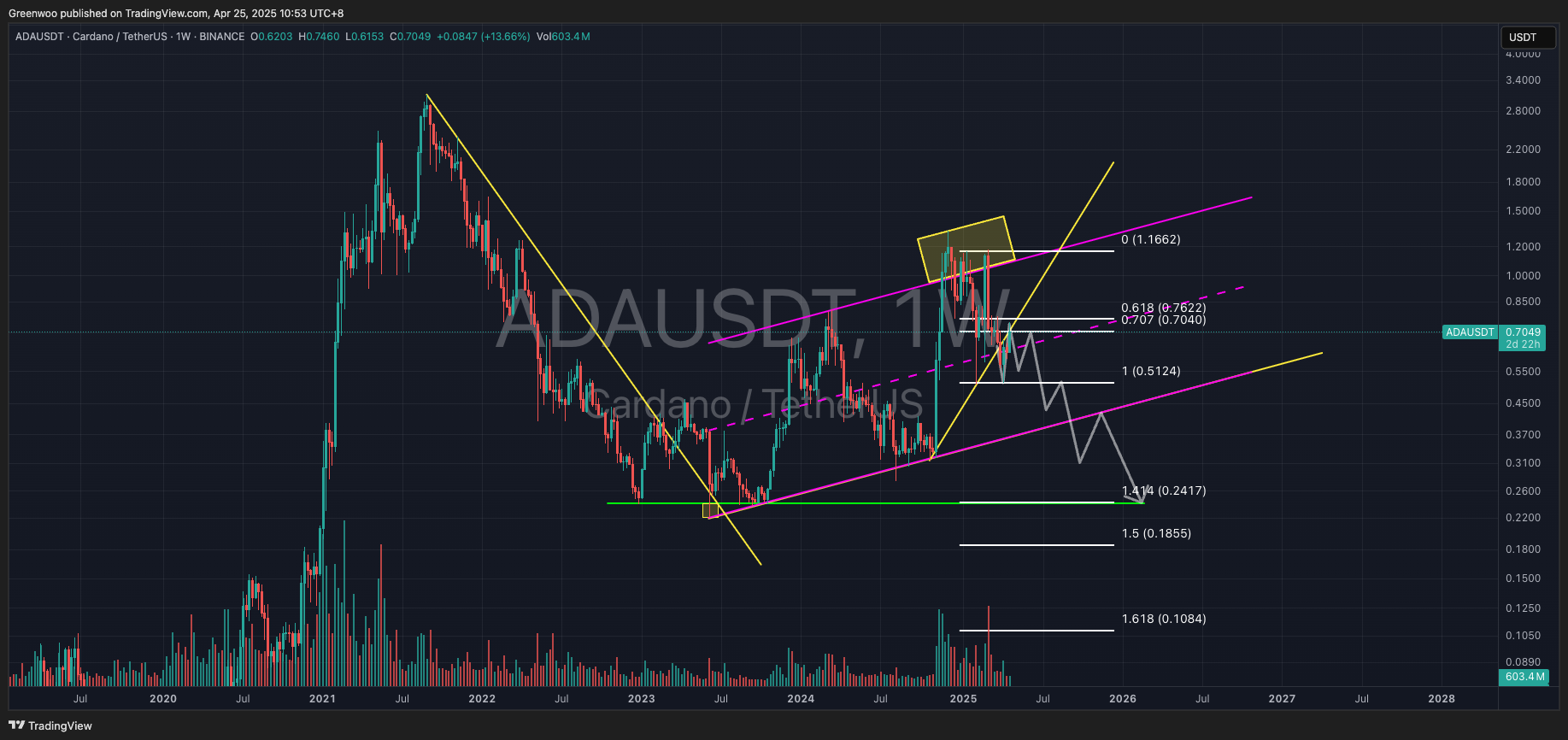

ADA's price action is similar to LTC, having been on an upward trend since mid-June 2023, gradually forming an ascending channel (purple parallel channel). However, ADA repeatedly failed to break through the upper boundary of this channel during attempts in late November and early December 2024. There was another failed breakout attempt in late February this year, followed by a quick pullback (yellow rectangle).

This indicates strong overhead pressure and insufficient bullish momentum. Coincidentally, the price has recently broken below the ascending trendline (yellow trendline). The price has rebounded somewhat recently, currently positioned below the trendline. This is likely a pullback to test the previous support as resistance, presenting a relatively good short entry point.

Volume analysis also reveals some clues. While trading volume increased during price rallies, the upward movement was relatively slow. Conversely, during price declines, the volume was not only higher but the downward movement was also faster. All these signs suggest a higher probability of a downward movement.

On another note, regarding Trump's executive order requiring the Treasury Secretary to submit an assessment report on establishing a Bitcoin reserve within 60 days, the deadline is May 5th, leaving less than two weeks. Besides Bitcoin, Trump initially mentioned XRP, SOL, and ADA as potential candidates for the reserve. XRP and SOL both have practical applications, with Ripple actively seeking cooperation with US regulators. Solana also has a meme coin craze and various infrastructure developments. In comparison, ADA has virtually no real-world applications.

In terms of practical applications, ADA is clearly the weakest performer among these cryptocurrencies. Therefore, the author believes that if the market is not satisfied with the report's outcome, it could further damage market confidence. ADA is likely to be the most affected by this.

In summary, here are some reference points:

Direction: Short

Entry: $0.76 – $0.713 (Fib 0.618 - Market Price)

Take Profit: $0.39 / $0.25

Stop Loss: $0.78 (Previous High)

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.