[Bitop Review] NVIDIA's Market Cap Surges to $4 Trillion, Bitcoin Challenges $112K, Hitting Record High

2025年07月10日发布

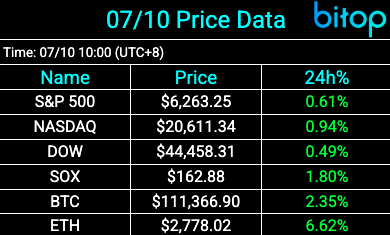

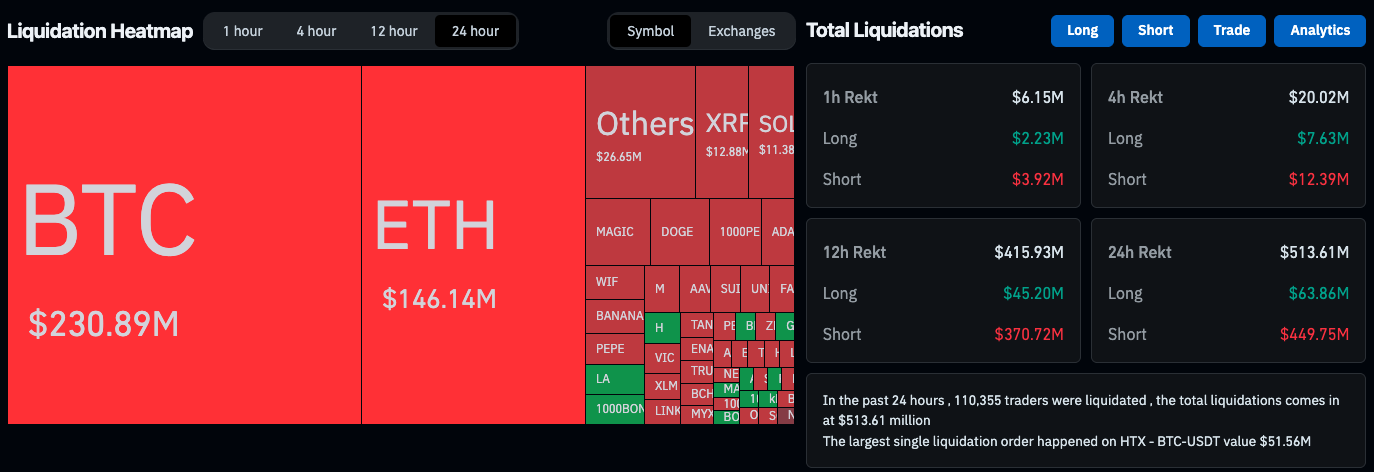

NVIDIA’s market capitalization soared to $4 trillion during trading, marking a historic first. Traders brushed off tariff concerns, with the CNN Fear & Greed Index currently signaling extreme greed. Bitcoin once again challenged $112K, with exchange data showing it peaked at $111,999 this morning, surpassing its previous high of $111,980 on May 22, setting a new all-time record. Ethereum rose to $2,778, up 6.6% in 24 hours. The cryptocurrency market saw $514 million in positions liquidated within 24 hours.

Fed Minutes: Policymakers Divided on Interest Rate Outlook

Federal Reserve meeting minutes revealed divisions among policymakers regarding the interest rate outlook, primarily due to differing expectations on how tariffs might impact inflation. The June 17-18 Federal Open Market Committee minutes noted that while a minority of participants argued tariffs would cause a one-time price increase without affecting long-term inflation expectations, most suggested tariffs could have a more sustained impact on inflation.

NVIDIA Breaks $4 Trillion Mark, Goldman Sachs Raises U.S. Stock Outlook

Despite frequent trade-related news, markets have entered a calmer phase, with reactions to tariff news gradually subsiding. The next catalyst is earnings season. Given the significant rally since April, heightened investor expectations, and the potential need for a period of consolidation, this transition may introduce some volatility.

NVIDIA’s stock surged to a new milestone, becoming the first company to exceed a $4 trillion market cap, marking a remarkable rebound after a challenging start to the year. Since early 2023, the stock has risen over 1,000%. NVIDIA now accounts for 7.5% of the S&P 500, near its historical peak.

Fast-money investors, after a strong rally, are gradually returning to U.S. stocks.

Goldman Sachs strategists upgraded their U.S. stock market outlook, citing the continued strong performance of America’s largest companies as a key reason for potential further gains.

Bitcoin Challenges $112K, $500M in Liquidations Across Market

Bitcoin tested $112K again, with exchange data showing a peak of $111,999 this morning, surpassing its May 22 high of $111,980, setting a new record. Ethereum rose to $2,778, up 6.6% in 24 hours.

The crypto market saw $514 million in liquidations within 24 hours, with Bitcoin accounting for $231 million, followed by Ethereum at $146 million. The Coinglass Fear & Greed Index has reached 72, indicating a greedy market sentiment.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.