[Bitop Review] Tether Holds Over $23 Billion in Gold! Ardoino: Aiming to Become a Global Gold Powerhouse

2026年01月29日发布

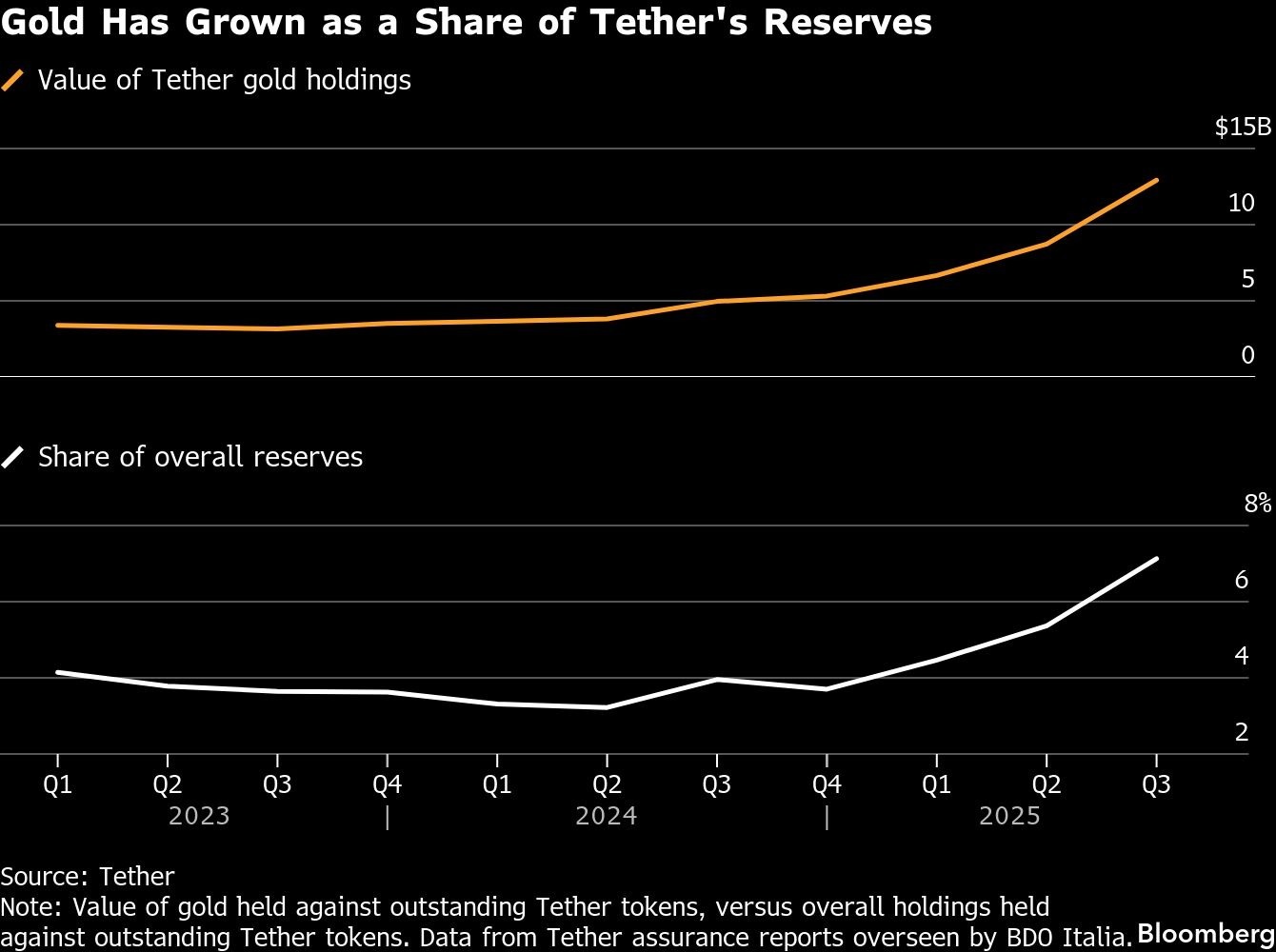

Stablecoin issuer Tether has quietly emerged as a force to be reckoned with in the global gold market. In recent years, the company has aggressively purchased physical gold for its reserves and its tokenized gold product, XAUT. Its current holdings of 140 tons now rival those of various national central banks.

From Stablecoin Profits to Physical Gold: Tether’s Asset Portfolio Expands Rapidly

Tether has accumulated a massive amount of gold over the past year. In a recent interview with Bloomberg, CEO Paolo Ardoino revealed that the company currently holds approximately 140 tons of physical gold, valued at around $23 billion. This scale surpasses the reported holdings of the world's three largest gold ETFs and makes Tether the largest known independent holder of gold reserves outside of central banks, ETFs, and private banks.

Ardoino noted that the company added over 70 tons of gold last year, with a purchasing speed of 1 to 2 tons per week. Furthermore, if the market cap of its tokenized gold, Tether Gold (XAUT), grows to between $5 billion and $10 billion in the future, they would need to purchase an additional 1 ton of gold per week. Currently, XAUT has an issuance backing of approximately 16 tons of gold, with a market cap of about $2.7 billion.

Self-Custody of Gold! Inside the Mysterious Swiss Nuclear Bunker

Unlike traditional financial institutions, Tether has chosen to maintain control over the physical custody of its gold. The gold is stored in a nuclear bunker built during the Cold War era in Switzerland, featuring multi-layered security mechanisms. Ardoino described the facility as something out of a "James Bond scene."

From Hoarding Gold to Building a Trading Platform: Tether Targets Traditional Institutions

At the same time, Ardoino made it clear that one of Tether's goals is to build the world's best gold trading platform and directly compete with financial institutions that dominate the global gold market, such as JPMorgan and HSBC. "Our goal is to have stable and long-term channels for gold acquisition," he stated.

To this end, Tether has recruited two senior gold traders formerly with HSBC to research trading strategies involving physical gold and futures spreads, formally extending Tether's positioning into a scope similar to that of a precious metals trading bank.

The "Gold Central Bank" Narrative Takes Shape, Tokenization is the Next Step

Ardoino has repeatedly pointed out that gold is safer than any single national currency in turbulent environments. He also anticipates that some of the United States' geopolitical rivals may launch "gold-backed currencies" as alternatives in the future.

Against the backdrop of wavering global confidence in the US dollar system and the continued favor for gold by central banks and investors, Tether's asset allocation has long transformed from purely US Treasuries to a triangular configuration of "US Treasuries (Liquidity) + Gold (Inflation Hedge) + Bitcoin (High Growth)."

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.