[Bitop Review] Are the Whales Back? Strong Accumulation of 53,000 BTC in One Week: The Battle for Bitcoin Chips Amidst Receding Hot Money

2026年02月11日发布

While the market remains immersed in pessimism with Bitcoin down nearly 40% from its October highs, on-chain data has captured a powerful undercurrent from the deep. Over the past week, "whales" have accumulated approximately 53,000 Bitcoin against the market trend, with a total value exceeding $4 billion. Meanwhile, the "Hot Capital Share" indicator has fallen below key support, signaling a thorough clearing of speculative bubbles. Is this exchange of chips between major holders and retail investors a signal of a market bottom turning the tide, or merely a temporary measure to prevent a crash?

Whales Accumulate Against the Trend, Injecting Over $4 Billion in a Single Week

According to Glassnode data, "whale" wallets holding more than 1,000 Bitcoin have ended months of reducing holdings, accumulating a total of about 53,000 Bitcoin in the past week. This powerful buying force played a key supporting role when Bitcoin retested the $60,000 level, successfully curbing further price declines. This also marks the largest single-week accumulation record since last November. Analysts point out that while this buying behavior led by major holders has stabilized market confidence in the short term, without follow-up from broader funds, relying solely on the game of existing capital may be difficult to push prices quickly back to historical highs.

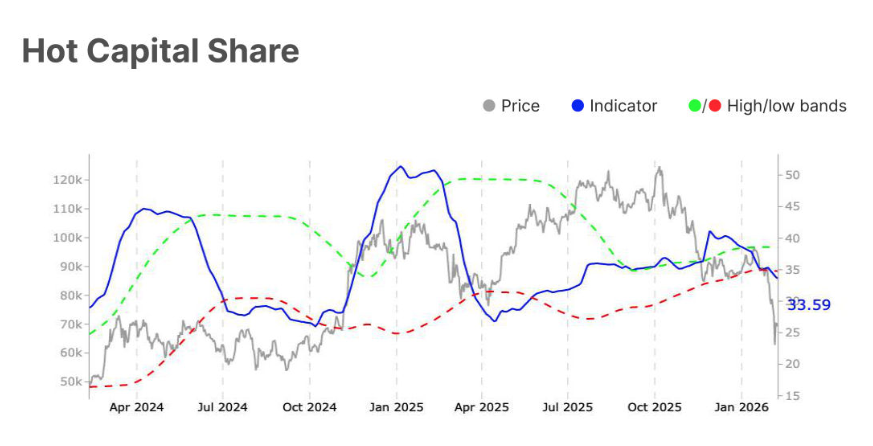

Hot Money Share Breaks Lower Bound, Speculative Bubble Significantly Subsides

Observing the latest "Hot Capital Share" chart, the indicator has fallen below the critical range of the lower red dotted line, with the value dropping to 33.59. This technical signal clearly indicates that short-term, reactive capital in the market is accelerating its exit, showing characteristics of "retail capitulation." The downward trend of the blue line symbolizes that the market is undergoing a thorough chip washout, with floating chips significantly reduced. As hot money recedes, the market structure is shifting to a cooling-off period dominated by long-term holders. This means that the risk of price volatility in the short term will be significantly reduced, but it also implies that the momentum driving a surge has temporarily stalled.

Lack of Incremental Funds to Take the Baton, Market Outlook Still Needs Macro Catalysts

Despite active protection by major holders, the market still faces the difficult question of "who will take the baton next." Many investors who entered through ETFs are currently in a loss state, with low willingness to increase positions; meanwhile, public companies that were previously active in adding Bitcoin to their balance sheets have also slowed their purchasing pace due to pressure on their own stock prices. The current market rebound lacks broad participation, and defensive buying by whales alone is difficult to form a sustainable upward trend. Investors should closely monitor Federal Reserve policies or new regulatory dynamics; only the injection of new macro liquidity can reactivate ETF funds and break the current price deadlock.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.