[Bitop Review] Bitcoin Dips to 67K Despite Unexpectedly Strong U.S. Jobs Data

2026年02月12日发布

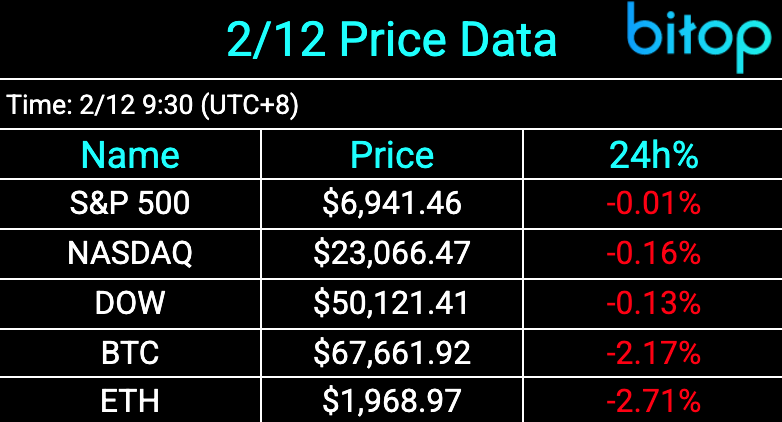

An unexpected surge in U.S. employment data has put pressure on Treasuries, causing traders to scale back bets on Federal Reserve interest rate cuts this year, with U.S. stocks closing slightly lower. The cryptocurrency market continues to trend sideways to downward, with the total market capitalization dropping 2.08% to 2.3 trillion. The Fear & Greed Index remains in the "Extreme Fear" zone at 9. Bitcoin (BTC) briefly dipped to 65K yesterday but recovered above 67K by press time. Ethereum (ETH) has fallen below the 2,000 mark. Overall confidence in the crypto market remains fragile.

Strong Non-Farm Payrolls Dampen Rate Cut Expectations

The latest U.S. monthly jobs report shows that the economy added 130,000 jobs in January—double the median forecast and the largest increase in over a year. The unemployment rate unexpectedly declined, indicating continued stabilization in the labor market. This report highlights robust economic momentum, suggesting that an immediate easing of monetary policy may not be necessary.

The current strength of the U.S. economy offsets the need to lower borrowing costs, supporting risk sentiment that has recently been battered by concerns surrounding artificial intelligence. The next key hurdle for the market is Friday's U.S. inflation report. If price pressures fail to ease, the report could further reinforce the case for maintaining high interest rates.

Crypto Market Trends Downward as Sentiment Weakens

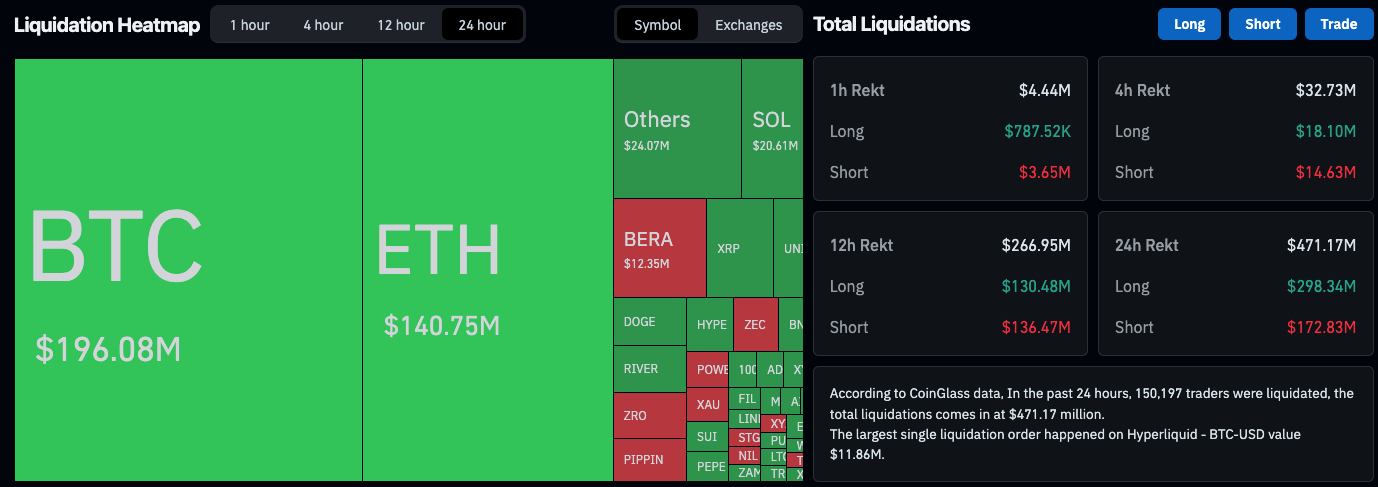

The cryptocurrency market continues to trend sideways with a downward bias, as the total market capitalization fell by 2.08% to 2.3 trillion. The Fear & Greed Index remains stuck in the "Extreme Fear" zone at 9. According to Coinglass data, network-wide liquidations over the past 24 hours totaled 471 million, with a long-to-short liquidation ratio of approximately 2:1.

Bitcoin briefly dropped to 65K yesterday before rebounding above 67K by press time. Ethereum has broken below the 2,000 level. Overall confidence in the crypto market remains weak.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.