[Bitop Review] AI Panic Spreads: Standard Chartered Cuts Bitcoin Price Target, BTC Risks Retest of $50,000

2026年02月13日发布

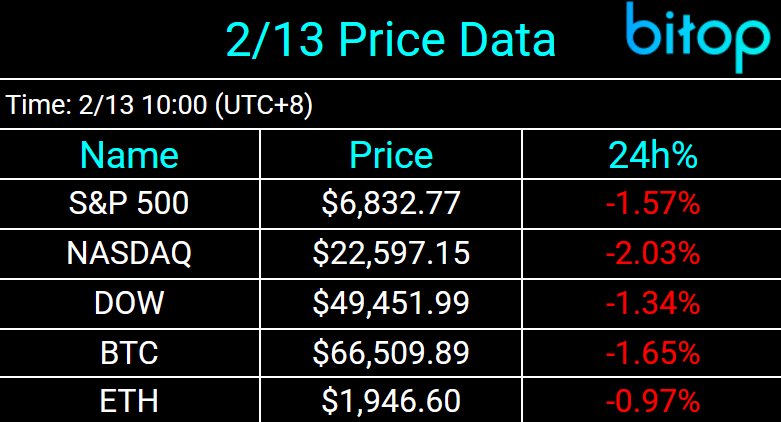

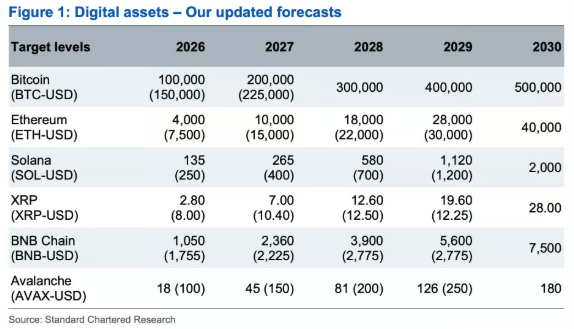

The potential disruptive impact of artificial intelligence continues to spread, weakening U.S. tech stocks and Bitcoin prices, while silver plummeted as investors flocked to the safe haven of the U.S. Treasury market. Bitcoin (BTC) continued its decline, dipping to a low of $65,118 earlier this morning. Standard Chartered analysts have revised their year-end 2026 target price downward from the original $150,000 to $100,000. They also anticipate that Bitcoin prices could fall to $50,000 (or slightly below), while Ethereum could drop to $1,400.

AI Risks Continue to Spread

Sharp volatility in the U.S. stock market reflects the growing risks associated with the AI boom and its unpredictable ripple effects across various industries, regions, and asset classes. These fluctuations highlight how quickly shifts in sentiment surrounding AI can spill over into broader sectors beyond technology.

Cisco shares plunged 12% as weak margin forecasts signaled that rising memory chip prices are taking a toll. This wave of decline, spreading from tech stocks to sectors like logistics and commercial real estate, indicates investor concerns over the impact of AI.

Traders are closely monitoring the key inflation report due on Friday. Market median forecasts suggest that the Core Consumer Price Index (excluding food and energy) will rise by 2.5% year-on-year.

Bitcoin Continues to Fall, Standard Chartered Lowers Target

Bitcoin (BTC) continues its downward trend, touching $65,118 this morning. Amidst this, Standard Chartered analysts have revised their year-end 2026 target price downward, from the original $150,000 to $100,000.

Geoffrey Kendrick, Global Head of Digital Assets Research at Standard Chartered, stated:

"I think we are going to see more pain and a final capitulation period for digital asset prices in the next few months. The macro backdrop is unlikely to provide support until we near [Kevin] Warsh taking over at the Fed."

He also predicts that Bitcoin prices could fall to $50,000 (or slightly below), and Ethereum prices could drop to $1,400. However, he views these levels as excellent buying opportunities.

Standard Chartered also lowered its year-end target prices for various crypto assets, adjusting Bitcoin from $150,000 to $100,000, and Ethereum from $7,500 to $4,000.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.